The life of an allied health traveler is full of adventure. New places, new people, and the chance to make a real difference in the world – it’s an amazing career! But with all that excitement, it’s easy to put off thinking about the future, especially retirement.

A 401(k) is a tool that helps you save for retirement while enjoying the benefits of travel nursing. With this tool, you can automatically set aside money from each paycheck and watch it grow over time.

This guide breaks down everything you need to know about 401(k)s as an allied health traveler. We’ll cover the basics, the unique challenges you might face, and how to make the most of your savings.

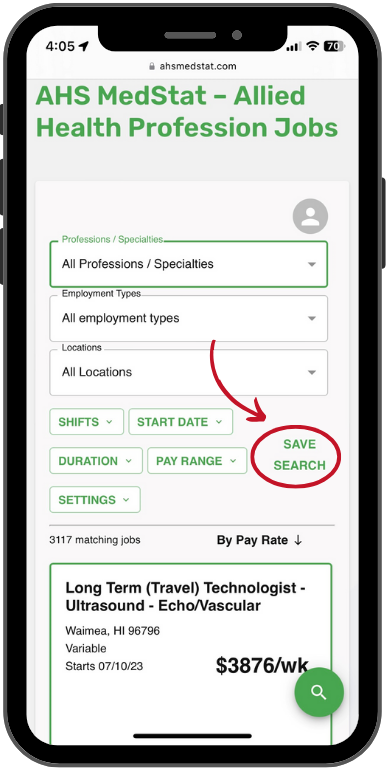

AHS MedStat offers exciting allied health travel jobs and helps you secure your tomorrow by facilitating a 401(k) for you as our employee. Talk to one of our recruiters now to learn how it all works!

So What Exactly is a 401(k)?

Okay, let’s get down to basics. Simply put, it’s a retirement savings plan offered by your employer. It allows you to contribute a portion of your paycheck to a special account. This account invests your money in things like stocks and bonds, which have the potential to earn higher returns than a regular savings account. The best part is that you don’t have to pay taxes on that money until you retire.

When you have a 401(k) set up through your employer, like AHS MedStat, they may offer “matching contributions.” This means they’ll put extra money into your 401(k) based on how much you contribute – essentially, free money!

There are two main types:

- Traditional 401(k): You contribute pre-tax money, meaning you lower your taxable income now. You’ll pay taxes when you withdraw the money in retirement.

- Roth 401(k): You contribute after-tax money, meaning you pay taxes on it now. But, when you retire, your withdrawals are tax-free.

A few key terms to know:

- Vesting: This refers to when you actually own the money your employer contributes. You might need to work for a certain amount of time before it’s fully yours.

- Rollover: This is when you move your 401(k) money from one account to another, like when you change jobs.

- Contribution limits: There’s a limit on how much you can contribute to your 401(k) each year.

Navigating the Roadblocks

While 401(k)s are a fantastic way to save for retirement, allied health travelers face some unique challenges. The very nature of your job – moving from one location to another, working with different employers – can make managing your 401(k) a bit tricky.

If you are continually moving between different allied health job agencies, you’ll have a decision to make about your old 401(k). Do you leave it with your previous employer? Roll it over to your new employer’s plan? Or, roll it over into an Individual Retirement Account (IRA)?

Plus, each employer has its own rules about 401(k) matching. Some may match a higher percentage of your contributions than others, or have different vesting schedules.

Additionally, if you choose to work with agencies based in different states, you’ll need to be aware that each state has different tax rules for retirement plans. As you move around, it’s important to be aware of how your 401(k) might be taxed.

The good thing is, you can essentially remove all these roadblocks by simply staying as an employee of one trusted agency, and choosing from the variety of allied health travel jobs they offer. At AHS MedStat, we can equip you with the strategies you need to make smart decisions about your retirement savings, no matter where your travels take you.

Saving Strategies for Allied Health Travelers

Now that you understand the basics and the challenges, let’s look at how you can truly maximize your 401(k) while working in allied health travel jobs.

1. Start Early and Contribute Consistently

Time is your greatest ally when it comes to saving for retirement. The earlier you start, the more time your money has to grow. Thanks to the magic of compound interest, your money earns interest on itself, snowballing over time.

Even small contributions add up significantly in the long run. Aim to contribute as much as you can comfortably afford, even if it seems like a small amount.

Tip: Set up automatic contributions from each paycheck. This ensures you’re consistently saving, even when life gets hectic.

2. Don’t Miss Out on Free Money

Many employers offer matching contributions to your 401(k). This is essentially free money! They’ll match a certain percentage of your contributions, up to a certain limit. For example, at AHS MedStat, we match your contributions up to 5% of your salary. To get the maximum match, you’d need to contribute 5% of your salary.

Tip: Treat your employer’s matching contribution as part of your salary. Factor it into your budget and contribute enough to get the full match.

3. Diversify Your Investments

Diversification is key to managing risk. Spread your investments across different asset classes, such as stocks, bonds, and mutual funds.

- Stocks: Offer higher growth potential, but also come with higher risk.

- Bonds: Generally less risky than stocks, but may offer lower returns.

- Mutual funds: Allow you to invest in a diversified portfolio of stocks and bonds.

- Target-date funds: Automatically adjust your asset allocation based on your target retirement date.

Tip: If you’re unsure how to diversify, consider a target-date fund or seek advice from a financial advisor.

Travel Adventures and Financial Security – Allied Health Jobs

Ready to embark on your allied health adventure with the peace of mind that comes from a secure retirement plan? Connect with AHS MedStat today! We offer exciting travel job opportunities and the support you need to navigate your career.