There’s a ton to know about allied health travel jobs before you take the plunge and find your first assignment. Being a traveling allied health professional comes with many advantages, including top pay, travel, and freedom. However, keep in mind that taxes may be a little more tricky as a traveler compared to a permanent position. The good news is that we have some helpful tips regarding taxes and allied health travel jobs. Of course, you should always check with a qualified tax professional based on your personal circumstances, but below you’ll find some general information about taxes as a traveling healthcare professional.

If you’re ready to start your career as an allied health traveler, get in touch with our recruiters or explore our job board now.

What are Allied Health Travel Jobs?

Before we get into the particulars about taxes, you might be wondering what allied health travel jobs are. These are jobs that allow you to practice in your specialty, like physical therapy or respiratory therapy, but on a temporary basis as you travel to different facilities. These allied healthcare jobs are generally to help fill in for staffing gaps at facilities in need. For instance, if another professional retires, leaves, or needs to take an extended absence. The traveler fills in for these staffing gaps for a certain period of time, such as 13 weeks. As a result, the traveler typically makes more than they would in a staff position, they get to travel across the country, and they also get more freedom and flexibility over their career.

Taxes for Allied Health Travel Jobs

Since you travel to different places throughout the year for allied health travel jobs, this comes with some unique circumstances regarding taxes. There are some common questions many travelers ask about taxes, and we’ve got some general information for you below.

When in Doubt, Talk to a Tax Pro

While we can provide you with some general information, taxes are different for everyone and they can be quite complex. So, you may need to talk to a tax professional. Tax professionals, particularly those that specialize in travel healthcare and travel nursing, are a great resource for understanding how taxes work for you and your family and can help you file correctly.

You Need a Tax Home to Have Non-Taxed Stipends for Allied Health Travel Jobs

One thing that many people don’t understand about allied health travel jobs is the need for a tax home. You might know that allied health travelers typically have a compensation package that includes wages and benefits as well as stipends for things like housing and travel expenses. Usually, these stipends are non-taxable income and you don’t need to pay taxes on them. However, in order for this to be true, you need to have what’s called a tax home. A tax home is different from your primary residence and is the place where you mainly work. For instance, if you have a home in New Jersey but work permanently in New York City, your tax home is New York City. However, if you travel to a lot of different places throughout the year for allied health travel jobs, then it’s a little bit different.

How to Maintain a Tax Home

As a traveling allied health professional, you should talk to your tax professional about how to maintain a tax home for your specific situation. However, generally your tax home can be your primary residence, as long as you take certain steps. For instance, maintaining a home there, coming home at least once every 12 months, and not working in one geographical area for more than 12 months.

Some things that may help prove tax home for tax purposes include:

- Keeping your driver’s license in your home state

- Keeping your car registered in your home state

- Maintaining your voter registration in your home state

- Keeping records of living expenses at home, like mortgage/rent, utilities, home maintenance expenses, and house sitter fees

If you maintain a tax home, then you would have duplicate living expenses during your assignments, such as housing. Therefore, you would likely qualify for tax-free stipends. Generally, your compensation package includes the stipends anyway and it’s up to you to make sure you know whether they are taxable or non-taxed based on your individual circumstances.

Why You Might Not Want Non-Taxed Income

In some cases, you might not want to maintain a tax home or exempt yourself from the non-taxed income for your allied health travel jobs. If this is the case, usually you’ll still receive the same compensation and you’ll need to claim all the income on your taxes. There are a few reasons you might want to do this. One is that you don’t want to pay on a residence for a tax home. Another is if you want higher taxed income, such as if you need a loan or want to pay more into social security. So, think about what’s best for you.

You Need to File in All States Where You Worked Allied Health Travel Jobs

Many travelers work in multiple states throughout the year. This also affects your taxes. As a traveler, you will need to file a resident tax return in your tax home state. You’ll also need to file a non-resident tax return in all the states you work in as a traveling allied health professional. There may be exceptions if you live or work in a state with no state income tax. Don’t worry, though, filing in multiple states doesn’t mean you’ll pay twice or more. Usually, any taxes you pay in non-resident states provide a credit toward your home state taxes.

Ask What Expenses You Can Claim for Allied Health Travel Jobs

It’s also a good idea to keep track of all work-related expenses, such as mileage on your car to travel to different assignments, receipts for uniforms or scrubs, and expenses for professional development activities like continuing education or certifications. Then, you can ask your tax professional what you can and can’t claim on your taxes. Keep in mind that even if you can’t claim something like mileage on your federal taxes, state taxes may allow you to do so. Therefore, try to keep track of everything that might be important and then you and your tax pro can look through it later to see what is and isn’t claimable on your taxes.

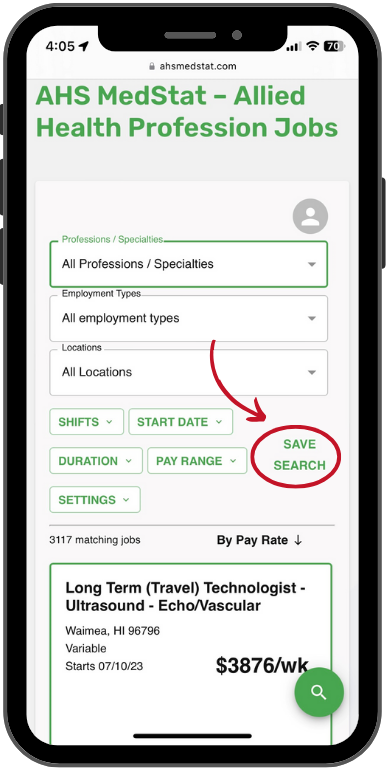

Find Travel Allied Healthcare Jobs with AHS MedStat

If you’re ready to get started as a traveling allied healthcare professional, reach out to our team at AHS MedStat today. We offer medical staffing solutions to the allied health industry and specialize in placing healthcare professionals with facilities who need their help. We get to know you and your goals so we can provide a personalized experience to help you find the right jobs for you. Contact our recruiters or apply to a job on our job board today to get started.